USD/CAD bulls get set for ther next bullish impulse from structure as Fed's Powell testifies

- USD/CAD is meeting a firm support area as Powell testifies.

- The bulls will be seeking an upside extension as the Fed turns hawkish.

USD/CAD is currently trading at 1.2328 and down a touch by 0.23% following an extension of the prior day's bearish correction.

Funds topped out at a post-Federal Reserve hawkish hold high of 1.2487 on Monday and on Tuesday, the price has drifted lower from a high of 1.2403 to a low of 1.2320.

The dollar edged higher at the start of the European session before Federal Reserve Chair Jerome Powell will testify before Congress.

FOMC Chairman Jerome Powell testifies on coronavirus pandemic response – live stream

Investors will be listening closely to the Q&A's to see whether Powell pushes back against the view that the Fed is likely to raise rates sooner than previously expected as inflation rises.

The greenback has firmed on the basis that US policymakers are forecasting two rate hikes in 2023, meaning that the Fed might now let inflation run at higher levels for a longer time before hiking rates.

However, the data will matter.

Fed's Powell has explained that employment is critical and will be assessed as to whether it would be appropriate to adjust policy.

Traders have already seen the prepared remarks of his testimony to Congress that were released on Monday.

In these, Powell stated that the economy continues to show "sustained improvement" expressing that there are ongoing job market gains, but he also warned that inflation has "increased notably in recent months."

The Q&A session may reveal more clarity on whether the Fed intends to withdraw stimulus sooner. On Monday, two US central bank officials advocated for the same although a third argued that it is too premature and any changes were still quite a ways away.

We have seen short-dated yields rise in recent days which took the dollar up with them. These will be in focus again today.

No matter what, the Fed has boosted FX volatility and if the US can escape the clutches of the zero-rate bound, then the greenback should remain firm.

As for positioning, speculators’ net long positions in the dollar index dropped back into negative territory in the snapshot taken the day before the June FOMC meeting.

This might explain the surge considering how poorly positioned the market was for the more hawkish stance. Net positioning in the DXY will have bounced back sharply in the next set of data which will be encouraging for the medium-term outlook for USD/CAD especially considering that net speculators’ long CAD positions continued to fall from their recent highs.

Meanwhile, the Bank of Canada came across as little less hawkish at the last policy meeting, so this too should play into the hands of the bulls.

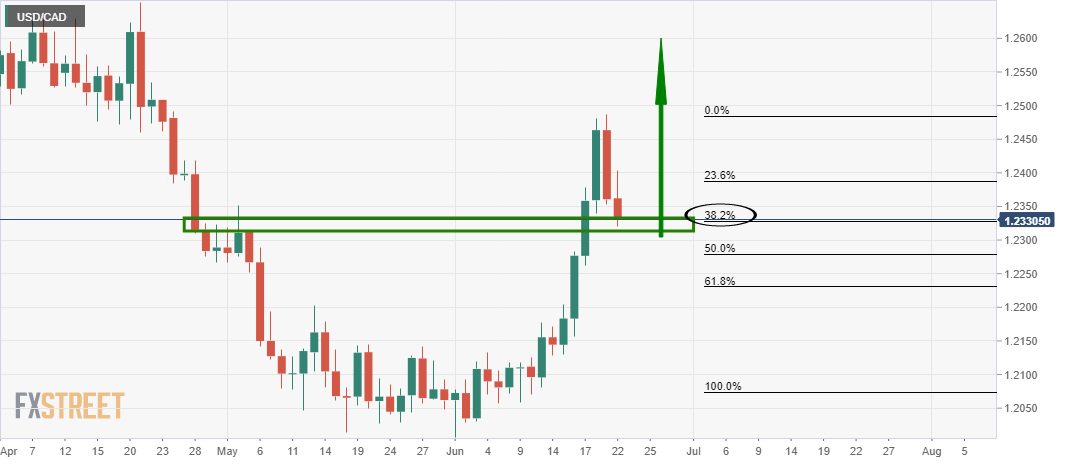

USD/CAD technical analysis

The price has dropped to the 38.2% Fibo areas between 1.2330 and 1.2320.

This is an area of the structure looking left and the price would be expected to hold these initial tests which could equate to the next bullish impulse and fresh cycle highs.