Back

12 Feb 2020

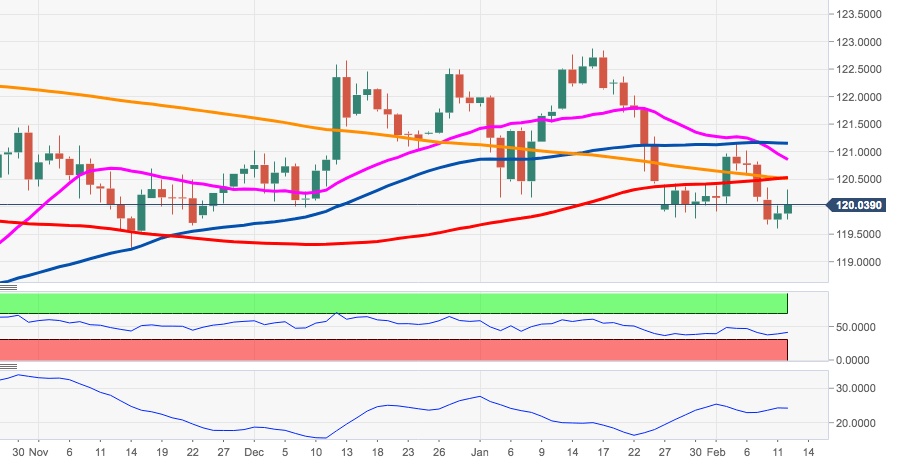

US Dollar Index Price Analysis: Corrective downside could re-test 98.54

- The rally in DXY met some tough barrier in the boundaries of 99.00.

- The correction lower carries the potential to extend to the mid-98.00s.

DXY came under renewed selling pressure after reaching fresh 2020 highs in levels just shy of 99.00 the figure on Tuesday.

The current knee-jerk is supported by some profit taking sentiment coupled with ‘oversold’ levels. Against this backdrop, the next target on the downside appears the November peak at 98.54.

While above the 200-day SMA, the downside should be regarded as corrective only.

DXY daily chart