Unsere besten Spreads und Konditionen

Über die Plattform

Über die Plattform

GBP/USD has been a solid performer this week, relishing in the prospects of a soft Brexit where it is quite frankly inconceivable that the UK will leave next month with a deal, according to the majority of the markets. However, PM May warns that a no-deal is still on the table and preparations are being made for such a scenario.

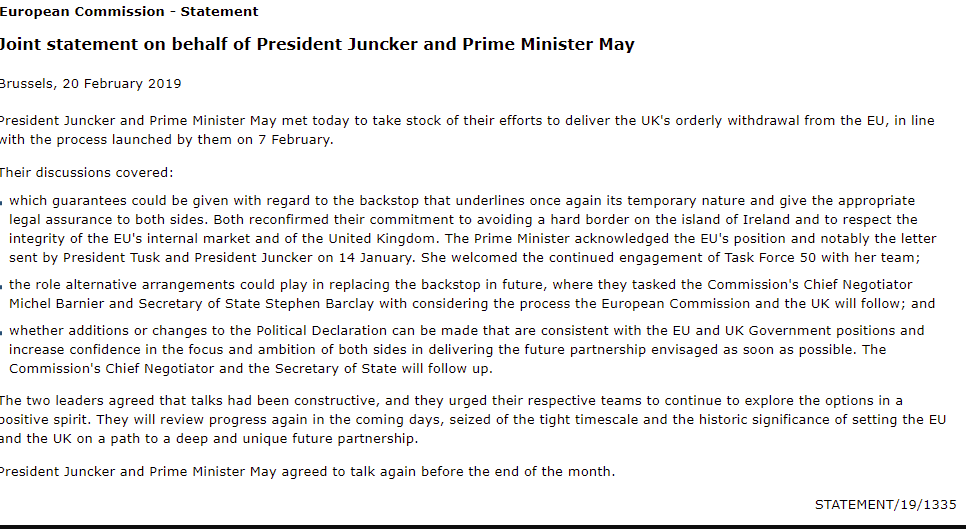

However, the core to the pound's strength is related to the BoE and risk-FX overdrive of late. Recent UK data has been solid and a BoE rate hike will likely be on the cards, regardless of whatever type of Brexit. Inflation will need to be tamed in the case of a weaker pound on a hard Brexit or even in the case of a stronger economy if all goes well with the EU following the outcome of Brexit. Meanwhile, Juncker has said timing is of the essence and they have made progress today in a meeting that took place regarding the backstop where PM May has said that she had underlined the need for legally binding changes to the backstop at the meeting with Juncker. Additionally, FX markets have favoured the central bank meetings as an excuse to be long of risk, leading to a sell-off in the dollar.

As far as the FOMC minutes event, it was not much of one and failed to inspire the bulls to keep buying the US indices. Instead, short-covering the greenback lifted the DXY from the session lows down at 96.29 to a post-event high 96.56. Additional work from the bulls will be required if the DXY is to break back above the menacing bearish H&S on the hourly charts, however - That level is located around 96.70. The FOMC minutes essentially echoed the neutral rhetoric we heard earlier in the week from Mester (hawk turned neutral) and Williams. The key takeaway is the Fed is considering the balance sheet policy for the latter part of 2019 and unsure what to make of the current climate with respect to their interest rate cycle - Thus, the Fed is neutral and seen holding for the foreseeable future.

Key statements form FOCM minutes, (Source LiveSquawk):

GBP/USD levels

GBP/USD continues to show signs of near term recovery following its recent reversal ahead of the 61.8% retracement at 1.2740, as noted by analysts at Commerzbank who explained cable has overcome the 200-day ma at 1.3002 to alleviate downside pressure. "Our attention has reverted to the 1.3217 recent high. The intraday Elliott wave counts are conflicting."